Abacus Market — the largest Bitcoin-enabled Western darknet marketplace — disappeared in early July 2025, leaving users without access to their funds. TRM Labs suggests the platform likely conducted an exit scam, though a covert law enforcement seizure cannot be ruled out.

The shutdown follows a series of major darknet marketplace (DNM) takedowns, including Archetyp Market’s June 2025 seizure, raising questions about the future of Western DNMs. This article explains how Abacus rose to dominance, what led to its sudden exit, and how the darknet ecosystem is adapting.

Keep reading to understand why Abacus’s demise is a turning point in the darknet market landscape.

What happened to Abacus Market?

Abacus Market went offline in early July 2025, with all clearnet and darknet infrastructure inaccessible. TRM Labs assesses it was likely an exit scam, though a covert law enforcement operation remains possible.

How the Exit Scam Likely Unfolded

Withdrawal Issues and Community Distrust

-

Late June 2025: Users reported withdrawal delays, a common indicator of exit scams.

-

Admin “Vito” blamed increased Archetyp user migration and a DDoS attack.

-

Deposit volume collapsed: from USD 230,000 daily in early June to USD 13,000 daily in July.

Comparison with Other Darknet Exits

-

Similar to Evolution Market’s 2015 exit scam and Nemesis Market’s 2023 disappearance.

-

No seizure banner, which typically appears in law enforcement operations.

Abacus Market’s Rise in the Darknet Ecosystem

Origins and Rebranding

-

Launched: September 2021 as Alphabet Market; rebranded as Abacus in November 2021.

-

Target audience: Global, with a strong Australian user base.

-

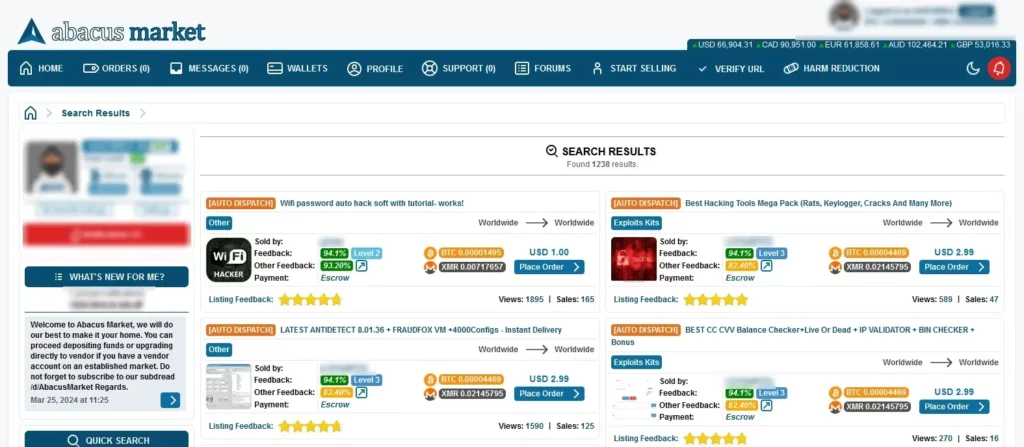

Products: Stimulants, psychedelics, opioids, benzodiazepines, prescription drugs, and cannabis.

Market Share Growth

-

2022: 10% of Western Bitcoin-enabled DNMs.

-

2023: 17% after ASAP Market’s closure.

-

2024: 70% market dominance following Incognito Market’s seizure.

-

Total Sales: Estimated USD 300M–400M including Monero transactions.

Did Abacus’s Success Lead to Its Shutdown?

-

High-profile DNMs become priority targets for law enforcement.

-

Archetyp’s June 2025 seizure likely pressured Abacus admins.

-

Admins may have chosen self-preservation over long-term profits.

The Darknet Ecosystem After Abacus

Law Enforcement Pressure

-

Agencies are shifting focus to vendor arrests, which disrupt multiple DNMs simultaneously.

-

Unannounced takedowns (e.g., Nemesis Market) allow intelligence gathering before arrests.

What’s Next for Western DNMs?

-

Smaller, low-effort markets like 3DogsMarket and Squid Market are filling the gap.

-

Remaining top players: DrugHub, TorZon Market, MGM Grand.

-

Migration to independent vendor shops and encrypted platforms (Telegram) is increasing.

FAQs

What happened to Abacus Market?

It went offline in July 2025. TRM Labs believes it was an exit scam, though a covert seizure cannot be ruled out.

Why was Abacus so popular in Australia?

It embraced Australian cultural references, recruited a local moderator, and supported Australian vendors.

How did Abacus’s exit affect other DNMs?

It disrupted vendors, causing migration to competitors like DrugHub and TorZon Market.

Did law enforcement shut down Abacus?

No official seizure notice appeared, but covert operations remain possible.

Why did deposits collapse before the shutdown?

Withdrawal delays eroded trust, causing deposits to drop over 90% in late June 2025.

Conclusion

Abacus Market’s disappearance highlights the growing instability of Western DNMs. With law enforcement pressure increasing and vendors migrating to encrypted platforms, darknet marketplaces are becoming more fragmented and short-lived.

The question now is whether remaining players will pursue growth at the risk of enforcement or prioritize self-preservation in an increasingly hostile environment.